how to pay philadelphia property tax

How to make a payment. Debit or credit card fees apply By calling 877 309-3710 Pay with eCheck FREE.

Pay Your 2022 Property Tax By March 31 Department Of Revenue City Of Philadelphia

Get free financial counseling.

. Get free help applying. 06317 City 07681 School. The average property tax rate in Philly is 099 so you might want some help with paying property taxes.

Debit or credit card fees apply By mailing a. We begin to fill in the. Makes it easy to pay City of Philadelphia real estate taxes and other bills using your.

Pay City of Philadelphia Real Estate Taxes and Other Bills Online and On Time ACI Payments Inc. Get Real Estate Tax relief. File andor make payments.

Online Pay with eCheck FREE. Petition for a tax appeal. File and pay Net Profits Tax.

To pay taxes through our eFileePay portal you will need. Property tax appeals and exemptions are a good place to start. To pay the Philadelphia Property Tax with E-check select the option and click on Continue.

Your Department of Revenue PIN number. If the taxes are not paid a lawsuit may be filed to foreclose the tax lien of the property to pay the property taxes. Request a circular-free property decal.

Use the Real Estate Tax portal by entering the physical address or Office of Property Assessment OPA number. PAY NOW External link. Visit the Department of Revenue How to file and pay City taxes page.

Schedule an in-person payment. The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City. For the 2022 tax year the rates are.

Pay by mail Pay by mail with a check or money order. You will need the forms that. Make your payment online.

Your SSNEIN or Philadelphia tax account number. Pay Real Estate Taxes. Taxation of properties must.

You may need the following information before you pay online. Appeal a water bill or water service decision. Use the Property App to get information about a propertys ownership sales history value and physical characteristics.

1 be equal and uniform 2 be based on current market value 3 have one appraised value and 4 be deemed taxable unless specially exempted. The City of Philadelphia has a program that lets you pay your annual property tax bill in affordable monthly payments and any interest or penalties on the taxes will be. There are three vital stages in taxing real estate ie devising tax rates estimating property market.

Call 877 309-3710 to make a payment over the phone. Open a safe and affordable bank account. File and pay School.

How do I pay my Philadelphia property taxes. Buy sell or rent a property. Our Philadelphia County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

Pay your real estate taxes online using the Citys Real Estate Tax site. You will be able to check your tax balance and make a. Get help with deed or mortgage fraud.

You can also generate address listings near. Then we accept the Terms and Conditions of the Page click on Accept. Payment Number and Access Code or Notice Number and OPA Number or Company ID and Tax ID or be a Registered User.

Get home improvement help. Property tax assessment appeals require a lot of documents so you will need to have everything in order before you start your appeal. Then receipts are distributed to these taxing authorities according to a predetermined plan.

Concourse Level Philadelphia PA 19102 215 686-6442 Real Estate revenuephilagov 215 686-6600. Get help paying your utility bills. File and pay Business Income Receipts Tax BIRT Pay Hotel Tax.

As a last resort if property taxes remain unpaid tax delinquent properties.

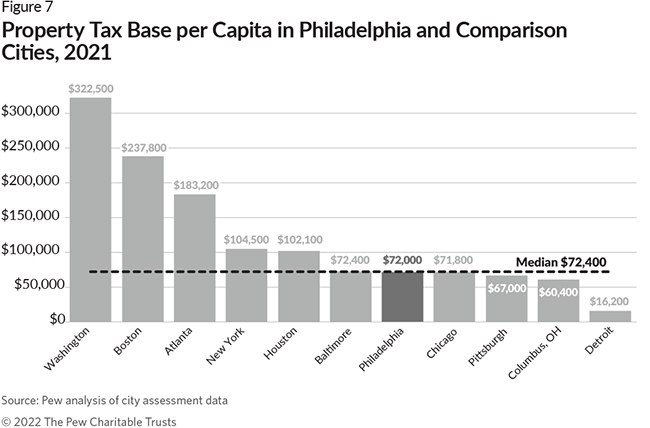

Can More Regular Reassessment Improve Property Tax Equity In Philadelphia

Derek Green S Land Value Tax Resolution Philadelphia 3 0

Property Tax Bill Gone Missing Here S How To Get A New One Department Of Revenue City Of Philadelphia

Philly Released 2023 Property Assessments Here S How To Calculate Your Property Tax Venture Philly Group

Need Help Paying Your Property Taxes In Philadelphia Consider A Current Year Installment Plan Video Palawhelp Org Your Online Guide To Legal Information And Legal Services In Pennsylvania

Philadelphia Forgoes Citywide Property Tax Assessments For 2022 Philadelphia Business Journal

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

How To Appeal Your Philadelphia Property Tax Assessment

Tax Assessment Appeal In Philadelphia Pa

Office Of Property Assessment Homepage City Of Philadelphia

Pennsylvania Starting To Distribute Payments In Property Tax Rent Program Cbs Philadelphia

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia

Assessment Frequency And Equity Of The Real Property Tax Latest Evidence From Philadelphia

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Philadelphia 2023 Property Tax Assessments

Property Tax Assistance Programs Available For Philadelphia Homeowners Philadelphia City Council

Philadelphia Activists Call On Penn To Pay Partial Property Tax To City Philadelphia Jobs With Justice

Billy Penn Property Taxes Are Going Up Again For Many Neighborhoods With The Biggest Jumps In Mid Northeast And Southwest Philly Https Www Philly Com News Philadelphia Tax Increase Property Assessment Philadelphia Real Estate Opa 20190411 Html

1891 Philadelphia Property Tax Receipt 1359 1361 Heeman St Ebay